CUSTOMER PROFILE

01 THE BEFORE

Aging infrastructure and limited room for improvement

Maps Credit Union’s contact center operation ran for several years on a basic, yet outdated solution that could only just cover standard operations. “We could take calls and help members, but we weren’t sophisticated in any way,” said Michelle Seymour, Maps Credit Union’s Assistant Vice President of Contact Center and E-Services.

Dashboards showed little beyond agent status and queue depth. Call recording was nonexistent, so supervisors could only monitor live interactions— there was no post-call review process. It was even complex and cumbersome to change IVR greetings and prompts, which meant menus were stale and there were missed opportunities to tailor for monthly promotions and seasonal events.

02 DESIRE TO CHANGE

Invitation to a fresh start

A new IT infrastructure leader joined Maps CU and shortlisted the phone system for improvement. The contact center operation saw this as their opening to improve. “I had been advocating for years about replacing our archaic, old system,” Seymour said. “And new blood in the organization helped us see that there were better solutions out there for our needs.”

Seymour and her team sought screen and call recording capabilities, integrated quality management - including call review and post-call member surveys, callback capabilities, and improved call flow. “We knew we needed to get with the times so we could keep focused on personalized, caring service,” she said.

03 THE SOLUTION

A quick decision with ongoing benefits

After a market review, Maps CU quickly decided on a suite of solutions from NICE CXone. Although replacing a long-incumbent system can often lead to change management challenges, staff were quick to welcome the switch. “As soon as staff saw the value it brought to them and the amount of talk and handle time CXone could cut down, they loved it,” Seymour said.

Unlike the previous solution, the Maps CU core member database is integrated into NICE CXone. This makes caller authentication faster and more secure, providing key details to agents via screen pop. Callers hear basic account information - including recent activity and balance - and are presented with callback options to avoid hold times. In addition to the authentication gateway, the IVR experience is now customizable on the fly through text-to-speech and easy call flow scripting. “Authenticating callers before they get to the agent and presenting agents with account information is a big win for everyone and makes a difference to both member experience and agent experience,” she said.

The new solution also helped Maps CU’s contact center management to align around key service areas, making it easier for supervisors to review calls and coach their teams. Supervisors even benefit from detailed real-time dashboards that assist them in identifying potential customer service issues through elevated talk time. Additional Maps CU departments are also now using NICE Quality Management templates to monitor and evaluate employee activity. To identify emerging scams and fraud, NICE Interaction Analytics screens calls to identify terms for potential fraud. Further, Maps CU has also been able to adjust its staffing structure and enable greater flexibility through NICE Workforce Management, which has accommodated hybrid work schedules while improving member service levels.

04 THE RESULTS

A more effective, efficient, member-friendly experience

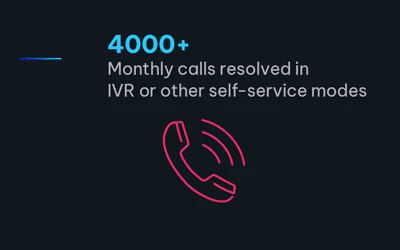

Since reinventing its contact center operation with NICE solutions, Maps CU has also resolved more customer interactions in self-service and asynchronous channels, deflecting several thousand calls per month while improving agent performance in live interactions. The smoother experience with fewer clicks and faster service has delivered several quantitative improvements.

Maps CU has also elevated how they handle post-call surveys by establishing a baseline for member expectations and connecting the feedback to individual agent interactions with NICE Feedback Management. While the credit union had satisfaction surveys in the past, the business intelligence team could not link results to contact center interactions. Feedback Management enabled them to gather actionable insights that have directly influenced operational changes. For example, many members expressed confusion regarding queue position and wait time information. In response to this feedback, the credit union promptly made adjustments to improve clarity in these areas. “We targeted an improved call experience for members, better agent experience, and a clear quality management program, and our NICE implementation delivered on those primary targets and much more,” Seymour said.

This proactive approach resulted in consistent CSAT scores, reflecting the success of their efforts in aligning member feedback with tangible improvements in service delivery. Employees easily transitioned to the greater flexibility of integrated voice, text, and chat service, and have signaled that stronger real-time dashboard insights help them in their work. NICE solutions have overall helped Maps CU more closely integrate its three distinct contact types into a single, comprehensive solution. “Because of how nimble the platform is, we can now run three very different teams in a single business unit, with our contact center, loss prevention, and tenant reporting all successfully working on NICE,” Seymour said.

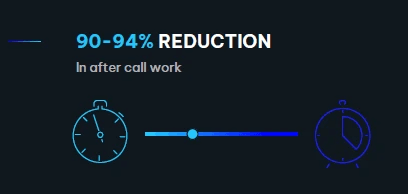

MAPS CU’s Loss Prevention department also saw significant results with their use of NICE Enlighten AutoSummary. Agents were previously taking two to three minutes after each call to manually type their notes into a third-party noting system. Since implementing AutoSummary, this department has reduced after call notetaking to approximately 20 to 30 seconds. “We expect this time saving to improve even more when we get a CRM tool in place,” says Seymour. “But for now, this solution is already saving our agents a lot of time.”

05 THE FUTURE

Greater customization and AI-powered insights

Maps CU plans to make more use of long-term member feedback to further tailor and customize contact center services. Scripting, powered by CXone Studio, has already helped the credit union improve call flow and there are more optimizations to come. “Our previous system was so limited that we didn’t know what was possible,” Seymour said. “Studio opens up new options for our call flow, menus, and scripting to improve the entire experience.”

The credit union also plans to deploy an AI-powered chatbot to streamline more transactions and queries without live agent involvement. “We plan to dive into AI for customer experience in the coming years, and we’re confident NICE is the right partner for that.”